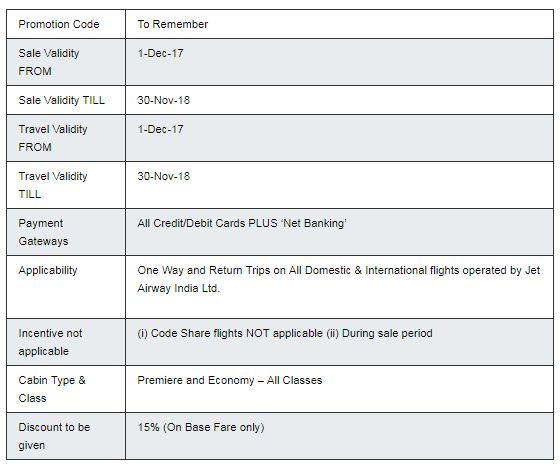

Jet Airways Concessional Fare offer for ICAI Members-Students on all clasess with 15% discount on Base Fare from 1-Dec-2017 to 30-Nov-2018

As per ICAI journal, ICAI has entered into an agreement with jet Air ways for concessional fare for its memebrs/students.

This Concessional Fare arrangement envisaged for ICAI Members & Students, and their identity shall be established on the basis of their Membership number/Student Registration number as the case may be. The concessional airfare rates shall remain in vogue with respect to any member/student so long as his/her Membership/Registration with the Institute continues.

The following table summaries the broad terms of the offer:

Steps involved in the Process

Step I: Pl ease visit the website www.jetairways.com

Step II: The promo code Box appears at the beginning of the reservation process. Put the “Deal Code” in the “Promo code Box” on top after entering travel details (source, destination, date of travel, one/two way etc.) and click aero plane sign shown at the end of the dialogue box.

Step III: Choose the flight in which you want to travel and click continue button shown at the end of the webpage.

Step IV: If you are existing Customer log in after entering your log in credentials and if you are not existing customer, Log in as a guest after entering your e-mail Id .

Step V: Enter your personal credentials; after entering personal details click the button continue contact details.

Step VI: In contact details you are requested to put all the contact credentials, at the end you are requested to insert the “Deal Code” in the “Corporate Deal Code Box

Step VII: Amenities provided by the airways will be shown, as per your convenience you have to choose or left out. In the end, you have to tick the small box for accepting terms & conditions of.

Step VIII: You have to make payment for receiving the ticket as per your travel plan.

N.B. Members /students will get the “Deal Code” in their registered E-mail Id of the Institute and requested not to provide the same to other Members/students are free to avail the tickets of any other entity.

Disclaimer: Travelers are advised to purchase the tickets as per the agreement signed by ICAI & Jet airways. It may be stated a member of the Institute, whether in practice or not, shall be deemed to be guilty of professional misconduct if he contravenes any provision of the aforesaid agreement. Nobody shall have any right or claim whatsoever against the Committee/Institute. All decisions about the aforesaid scheme shall be sole discretion of the Conunittee/Institute and binding on all.

Source: ICAI Journal of Dec-2017

Ministry.

Ministry.

Download :-

Download :-